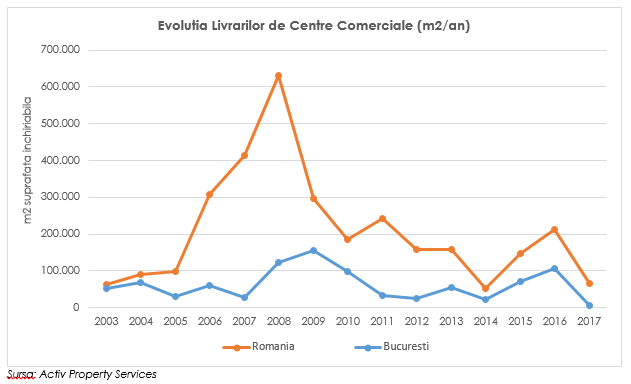

New shopping centre stock registered a modest evolution in 2017, accounting for only 66,700 sq m GLA at national level, with almost 70% below the previous year (2016 – 212,780 sq m GLA).

Only 2 new shopping centres (Shopping City Ramnicu Valcea, Platinia Cluj-Napoca) and 2 extensions (Shopping City Galati, AFI Palace Cotroceni) were delivered in 2017, compared with 4 new openings and 6 extensions in 2016.

SHOPPING CENTRES - OPENINGS 2017

|

No |

Shopping Centre |

City |

Type |

Developer |

GLA (sq m) |

|

1 |

Shopping City |

Ramnicu Valcea |

New |

NEPI Rockcastle |

27.900 |

|

2 |

Shopping City |

Galati |

Extension |

NEPI Rockcastle |

21.000 |

|

3 |

Platinia |

Cluj-Napoca |

New |

Vasile Puscas |

11.000 |

|

4 |

AFI Palace Cotroceni |

Bucharest |

Extension |

AFI Europe |

6.800 |

|

|

TOTAL |

|

|

|

66.700 |

|

Source: Activ Property Services |

|||||

“2017 saw one of the lowest volumes of openings, the market returning to the activity recorded 15 years ago, in 2003, the year that marks the start of the shopping centre development activity in Romania. Last year witnessed a premiere: it’s the first year during when closures of shopping centres outpaced the volume of openings, marking a relatively strange evolution, in contrast with the spectacular evolution of retail sales and the further development potential of the market.” says Florian Gheorghe, Head of Research at Activ Property Services.

While new openings totalized 66,700 sq m GLA, a total shopping centre stock of 82,820 sq m GLA closed activity in 2017 while considering also the closure of Bucharest’s Vitantis in the first days of this year.

SHOPPING CENTRES - CLOSURE 2017

|

No |

Shopping Centre |

City |

GLA (sq m) |

||

|

1 |

Oradea Shopping City |

Oradea |

30.000 |

||

|

2 |

Real |

Suceava |

19.890 |

||

|

3 |

Vitantis |

Bucuresti |

17.960 |

||

|

4 |

Real |

Constanta |

14.970 |

||

|

TOTAL |

82.820 |

||||

Source: Activ Property Services

Bucharest’s Market

A new stock of 6,800 sq m GLA was delivered last year in Bucharest, being represented by AFI Palace Cotroceni’s extension of 6,800 sq m GLA.

Bucharest’s market registered two negative premieres last year:

- For the first time during the last 15 years, no new shopping centre was opened last year;

- the total shopping centre stock reduced for the first time in Bucharest, decreasing by 11,160 sq m GLA, following the closure of Vitantis and the delivery of just 6,800 sq m GLA.

The total existing shopping centre stock in Bucharest reached 1,029,000 sq m GLA and a number of 30 schemes.

New Stock Announced for 2018-2019

A new stock of 154,100 sq m GLA is announced for opening in 2018, including 2 new projects and 5 extensions. However, it is unlikely that all these projects will be completed on time taking into account that for over 90% of them the construction was not started until the end of last year.

Further projects of 136,515 sq m GLA are announced for 2019, out of which only AFI Palace Brasov (45,000 sq m GLA) is under construction.

SHOPPING CENTRES - OPENINGS ANNOUNCED FOR 2018-2019

|

No |

Shopping Centre |

City |

Type |

Developer |

Year |

GLA (sq m) |

|

1 |

Shopping City |

Targu-Mures |

New |

NEPI Rockcastle |

2018 |

50.000 |

|

2 |

Iulius Mall |

Timisoara |

Extension |

Iulius Group |

2018 |

47.000 |

|

3 |

Shopping City |

Satu Mare |

New |

NEPI Rockcastle |

2018 |

28.700 |

|

4 |

Shopping City |

Sibiu |

Extension |

NEPI Rockcastle |

2018 |

10.600 |

|

5 |

Electroputere Parc |

Craiova |

Extension |

CatInvest |

2018 |

9.200 |

|

6 |

Ploiesti Shopping City |

Ploiesti |

Extension |

NEPI Rockcastle |

2018 |

6.200 |

|

7 |

Auchan Drumul Taberei |

Bucharest |

Extension |

Immochan |

2018 |

2.400 |

|

|

TOTAL 2018 |

154.100 |

||||

|

1 |

AFI Palace |

Brasov |

New |

AFI Europe |

2019 |

45.000 |

|

2 |

Festival Mall |

Sibiu |

New |

Primavera Development |

2019 |

42.000 |

|

3 |

Promenada Mall |

Bucharest |

Extension |

NEPI Rockcastle |

2019 |

34.000 |

|

4 |

Colosseum |

Bucharest |

Extension |

Nova Imobiliare |

2019 |

15.515 |

|

|

TOTAL 2019 |

136.515 |

||||

|

TOTAL 2018-2019 |

290.615 |

|||||

Source: Activ Property Services